Share |

Panama Canal activity contracts and ports slow

August 22, 2011

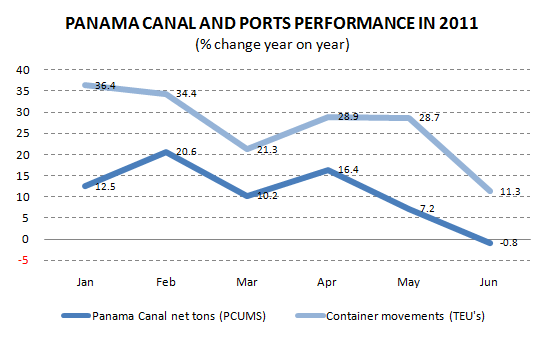

The latest economic indicators report from the National Institute of Statistics and Census (INEC) showed a slowdown in the Panama Canal activity to its contraction in June 2011. The Panama Canal net tons (PCUMS), which is an indicator that measures the activity of the Canal in real terms, without the influence of prices, grew 20.6% in February 2011 but then declined consistently until contract by 0.8% in June. The downward trend also occurred in toll revenues, as these are charged on PCUMS except for the case of cruises where tolls are collected based on the number of berths of the ship.

The obvious question now is whether this slowdown and contraction of Panama Canal activity is due to the crisis in U.S. and Europe, or whether it has simply been caused by some other phenomenon of the market in some segments of different types of ships transiting the Canal. To determine this we must review the monthly statistics by type of Canal transiting vessels and routes. However, at the time of writing this article could not do that because the information contained on the website www.pancanal.com of Panama Canal Authority (ACP) was too old to do that, such information is updated only until October last year, when finished the fiscal year. Because no information is available transit the Panama Canal this year at its Web site, we do not speculate on the reasons why the activity has been weakening.

The Panama Canal has several segments defined by the ACP by vessel type. The main segment is the container ships. Other relevant segments are dry bulk carriers, tankers, reefers, car carriers, cruise ships and general cargo. Each segment of these may not have the same routes and behave in different ways, as indeed it did during the global economic crisis. Thus, during 2008 and 2009, while the activity of sustained contractions container ships of up to two-digit per month due to the decline in trade between China and United States over the bulk ship through the Canal, carrying grain, had one of the best performance due to good harvest in United States, demand from China and the sharp fall in freight rates for dry bulks, given the excess capacity that resulted in the crisis. Paradoxically, in the same period, transit cruise instead of diminishing, increased in part due to influenza in the tourist destinations of Mexico, which ships diverted to other destinations and reasons for its passage through the Canal. At that time, car carriers ship itself strongly felt the impact of the crisis as a result of the sharp fall in car demand in United States and Latin America.

U.S. economic growth has been slowing and we would expect in this case, the same segments of types of ships transiting the Panama Canal, which were negatively impacted by the crisis, this time are also slowing to the extent that does the U.S. economy. However, also the downward trend of Panama Canal activity could also be due to a segment such as dry bulk carriers is causing the slowdown, either by a decrease in demand or supply of grain or by changes in transportation decisions, motivated by spreads between the Panama Canal tolls and freight through other means of transportation in the United States.

honestly, we do not know the causes of this loss of dynamism of the Panama Canal and would have to wait until all information is available to everyone on the website of the ACP.

Ports

For the rest of economic sectors, listed in that report indicators of INEC, there is a strong economy, except for the ports that are also showing, but highly positive growth rates, also a loss dynamism in correspondence with the slowdown of the Panama Canal. The movement of containers in ports grew 36.4% in January 2011 over the same month last year, but the rate, although still high, declined to 11.3% in June. Since in both cases we are talking about containers, it makes us think that the slowdown of the Canal and contraction in June could be due to decrease in the segment of container ships.

Is a recession looming in the U.S.?

The U.S. economy has lost momentum for two consecutive quarters. After growing 2.3% in the fourth quarter of last year grew only 0.4% and 1.3% in the first and second quarters of 2011 respectively. However the LED (which is an index that indicates when a looming recession, since it is built based on indicators that are usually ahead of what will happen in the U.S. economy) indicates that there is not a looming recession.

Impact of a recession in U.S. economy over Panama

We project in January this year, Panama's economy would grow 9.2% this year and 13% next year due primarily to a program of public and private investment of 45 billion dollars in the period 2010-2014. The Panama economy will grow at double digits in 2012 primarily because 2012 and 2013 were years of investment peaks, especially for major projects including the expansion of the Canal.

In the case of a U.S. recession, the Panama Canal would be negatively impacted the first activity since the main route is going from China to East Coast of the United States. With the recession and precipitate a meltdown in the price of oil, copper and raw materials, which impact negatively Venezuela and Chile, and also to Ecuador and Colombia. Venezuela and Colombia are the first and second purchaser of the Colon Free Trade Zone, respectively, so that the activity of this decrease. The slower growth in Latin America, besides affecting the Colon Free Trade Zone also impact the activity of container transshipment port, as these countries are also major users of these services. However, the air travel hub of COPA Airlines continue to grow. Obviously, the construction will grow at very high rates. Trade, hotels and restaurants continue to grow even at high rates.

During global economic crisis in 2009 Panama's economy grew 3.5%. With a U.S. recession, the Panama economy still continue to grow at a high rate, much higher than 3.5%, driven by construction and trade, among other sectors still continue to be dynamic.

We continue to think that the United States are not going into recession and we maintain our forecast of double-digit economic growth in 2012, published in January in http://www.panamaeconomyinsight.com.pa/0215011101.html . However, we will keep monitoring this situation to present a revised projection of all Panama economic sectors in October.

Related article

Panama's economy will grow 9.2% in 2011 and double digit in the following years